Table of contents

1 Crowdfunding can change the way we work in future

1.1 Crowdfunding may lead to higher growth for organizations

1.2 The problem in current enterprise crowdfunding systems

1.3 State of the art research relevant to crowdfunding

1.4 Summary of research findings supportive to enterprise crowdfunding

2 Process model for equity and lending enterprise crowdfunding

2.1 Four phases of an enterprise crowdfunding model

2.2 The stakeholders of an enterprise crowdfunding model

3 Qualitative interviews held with 3 employees

3.1 Questions for the qualitative interviews

3.2 Summary of interviews held on enterprise crowdfunding

3.3 Considerations derived from interviews

4 Summary and conclusion

5 Bibliography

6 List of tables and figures

Crowdfunding can change the way we work in future

Crowdfunding is a form of seeking financial support from a crowd. For those who seek financial support from a crowd, crowdfunding is a form of financing for a specific project from those who freely lend or invest money directly. Using crowds to generate and fund ideas to create innovations has demonstrated remarkable success. It comes to no surprise that corporations in search for organic growth want to utilize the form of idea generation and assessment through crowds. A new term called enterprise crowdfunding is not yet widespread and rests on principles of crowds used to create, collect, and assess ideas to support innovation. Enterprise crowdfunding utilizes the crowd of an internal organization of a business or corporation without the existence of hierarchical structures. Companies such as BMW, Audi and IBM have implemented crowdfunding into their internal organization. Enterprise crowdfunding as it is currently being applied is using single rewards or donation types of crowdfunding incentives to motivate participation. One-time financial benefits and recognition for engagement have an effect on decision-making, participation and an impact on the success of crowd-work and thus influence the success of crowd-work to be a fundamental element of future organization. Understanding motivational factors for employees to participate are an essential element for enterprise crowdfunding to work. An assumption is, that providing a lending and equity-based crowdfunding type to employees for their participation and collaboration will allow for crowd- work to form roots into organizational structures and secure long-term employee participation and talent retention. Thus, a crowdfunding methodology for lending and equity-based model is proposed for organizations seeking to implement an internal enterprise crowdfunding model fostering employee’s intrinsic motivation and supporting extrinsic incentives derived from successful innovations.

1.1 Crowdfunding may lead to higher growth for organizations

According to the scholar Henry, private investment saw a significant growth with the liberalization of stock markets. In a study conducted with 11 developing countries 9 countries experienced on average over a period of three years a 22 percentage higher growth rate than in their non-liberalization time. (Henry, 2000) This explains that involving private people into an otherwise non-liberated market would increase investments. Furthermore, a personal investment can bind people to a company or a project. With this it would be interesting to conduct further research in understanding how people are motivated to stay with a company or contribute towards a project when financial interests are present. Commonsense would suggest that people who have vested interests will be motivated to take care of their investments. From an interview conducted earlier this year with Siemens innovations manager it came apparent that employees participating in an enterprise crowdfunding campaign were requesting to invest their private money and financially support projects. This leads at least to the fact that there seems to be an interest from employees to participate in investment opportunities or support projects with their private money. Typically, a stock option program is restricted to senior management and thus is not available to all employees. Besides, stocks from a company reflect the total operation and external factors also, thus employees have a limited influence. An enterprise crowdfunding model where an investment can be linked towards an innovation or project would be more suitable for employees, as their performance could be linked directly with the project they vest. According to Franke and Klausberger an enterprise crowdfunding system is interesting as it can co-exist with a hierarchy organization which means it can be implemented without organizational change. (Franke et al., 2013)

1.2 The problem in current enterprise crowdfunding systems

Equity and lending forms of crowdfunding exist in form of open innovation between companies and individuals. An equity and lending type of crowdfunding has not yet been established for internal idea management inside an organization. Enterprise crowdfunding, which is restricted to internal organization is to date limited to donation and reward-based crowdfunding. Understanding that financial incentives and extrinsic motivation can be beneficial to intrinsic motivation, a methodology needs to be introduced to existing enterprise crowdfunding to allow for equity and lending forms of support for projects. In addition to providing a process and methodology for equity and lending enterprise crowdfunding model it is important to consider what elements need to be addressed when implementing such a system. In order to provide with a suitable model research will provide insight into understanding what key influencers exist. Based on current scientific insights a model for enterprise crowdfunding in equity and lending is introduced. Finally, qualitative interviews with employees will provide feedback on the concept of enterprise crowdfunding and highlight any concerns and interesting questions.

1.3 State of the art research relevant to crowdfunding

Thus, in the development of crowd work and new world of work, an enterprise crowdfunding environment would have potential to assist a form of new renumeration in a crowd work environment. Thus, it is important to understand how lending and equity forms of crowdfunding can be incorporated into enterprise crowdfunding models. Until now only donation or reward- based enterprise crowdfunding exists.

1.3.1 Why do people engage in crowdfunding?

In a study, Bretschneider argues that people engage in crowdfunding for financial returns, to collect rewards like products, for altruism, for fun, or because they identify with projects and project teams and want to support small-business owners’ innovative ideas (Bretschneider et al., 2014) The reasons that employees engage in enterprise crowdfunding differ that employees are able to articulate diverse unmet needs in new ways, and they are able to satisfy those needs through collaborative action. (Muller et al., 2013) However, according to Brown et all enterprise crowdfunding is still a very new concept and needs further research. (Brown, Boon, & Pitt, 2017) Thus, it is interesting to understand why participants engage in a crowd work type of environment and how this could be utilized for an enterprise crowd working environment. Against this backdrop, Kleemann and Gosh have analysed these conditions in open source and open content projects – when contributions are unpaid, extrinsic motivators are nevertheless often present. Subsequently career-related benefits and the desire to acquire new knowledge, to share expertise with others, and to reach common goals. (Kleemann et al., 2008)(Gosh, 2005) Further research by Schroer and Hertel indicate that strongly participating individuals reported an unfavourable personal cost-benefit balance. Participants are aware of the imbalance but possess an immanent willingness to participate anyway. (Schroer & Hertel, 2009). Franke and Klausberger conclude from their findings that participants are more likely to accept and to contribute when they perceive the project as being fair for them, participant obtain rewards (tangible or not), have intellectual rights over the ideas they submitted and have their say in making the related decisions. (Franke et al., 2013) This leads to further interesting research in how decision-making influences crowdfunding systems.

1.3.2 Decision-making in crowdfunding systems

A study by the scholar Reitzig points out that employees may tend to support ideas that are created by near and close colleagues, especially if they are part of a smaller subdivision inside an organization (Reitzig & Sorenson, 2013). Feldmann elaborates in his study that participants in an enterprise crowdfunding system may be prone to heuristic and system-1 decision making (Feldmann et al., 2014). And in his subsequent study, Feldmann et al, identify that idea quality, novelty, relevance or feasibility of a project played a minor role in employees to back and fund projects (Feldmann & Gimpel, 2016). These findings strongly indicate that system 1 thinking and nepotism might influence enterprise crowdfunding which limit the benefits for enterprise crowdfunding to be beneficial in an organization. If system 1 thinking reduces the quality in idea selection, then more emphasis should be paid to developing a model that supports system 2 thinking. Gómez, who suggests that further research would prove useful to understand how far employees could invest their private capital in the company’s projects. (Gómez et al., n.d.) It could be, that bringing in the concept of money may lead participants to system 2 type of thinking and decision making. Insights into concepts of money are warranted.

1.3.3 The concept of money and its implications

The assumption is that when employees would invest their own capital, they would invest cautiously and diligently. There are numerous studies that highlight the issues about introducing the concept of money and extrinsic rewards. Caruso points out that merely activating a money concept in people’s minds can make them more favorable toward existing social structures and more likely to see social inequality as acceptable (Caruso et al., 2013). Activating a monetary concept has also been shown to reduce people’s helpfulness toward others. Vohs suggests this and also indicates that even subtle reminders of money elicit big changes in human behavior. (Vohs et al., 2006) Although the concept of money bears disadvantages, Cholakova and Clarysse suggest that a combination of non-financial rewards, for example what is understood as call reward and pre-order, can be combined with financial rewards, as lending with interest and equity, without reducing the willingness of the funder to support the non-financial objectives. (Cholakova & Clarysse, 2015) It is therefore important to look into motivational theories about participation into crowdfunding systems.

1.3.4 An excursion into cognitive and social psychology for participation

The scholar Kreps summarized his analysis derived from cognitive and social psychology that individuals seek for rationales to justify an action when performing a task. An employee will rationalize his efforts based on the level of enjoyment for the task when there is no extrinsic incentive provided. Thus, if the enjoyment increases so will the efforts towards a task increase. Kreps indicates if extrinsic incentives are put in place, employees will focus efforts to reflect those incentives with a gradually increasing aversion towards the efforts. Thus economic incentives should only complement towards intrinsic motivation when the economic incentive emphases an unpaid kind of work. (Kreps, 1997) Lazear suggests that extrinsic incentives towards employees diminish intrinsic motivation and to reduced levels of efforts resulting in lower profits for employers. However Lazear also indicates that intrinsic motivation mostly is superior to extrinsic incentives but in certain cases extrinsic incentives can lead to significant increases in worker effort and employer profit (Lazear, 1996) Against this backdrop the overjustification effect needs to be considered. An effect of overjustification arises when an anticipated external reward like money or rewards reduce the intrinsic motivation of an individual to perform a task – a secondary motivation replaces an initial motivation. The overall effect of offering a reward for an action that was previously unrewarded is a shift towards extrinsic motivation and can weakening intrinsic motivation if it preexisted. (“Overjustification effect,” 2020) An overjustification effect only occurs when repeated and anticipated rewards are provided. Thus an overjustification effect in the case of enterprise crowdfunding would not happen easily, because returns from equity or lending investments are not certain, but it is important to consider overall payout magnitude and frequency in a lending and equity based crowdfunding system. Importantly Jirjahn indicates in his study that similar patterns arise in different types of performance pay regardless of individual based or group based performance pay and profit sharing. (Jirjahn, 2016) The study by Hennessey could indicate that a culture focusing on intrinsic motivation could deflect the negative effects of extrinsic rewards. In a study by Hennessey children were examined how extrinsic motivation would influence their creativity. The study concludes that if people are focused on intrinsic motivation and learn to see external incentives as secondary, they are able to maintain intrinsic motivation and sometimes even show increases in creativity when adding extrinsic motivation. (Hennessey & Zbikowski, 1993) In the same light, have scholars interviewed many professional artists who claim that contracted work can enable them to perform exciting work. Amabile points out that professionals who believe that reward programs reflect the importance of their contribution, their encouragement and creativity can be increased towards their success. (Amabile, 1993) Therefore it is misleading to categorically state, that bonuses will always decrease motivation in challenges and creativity. When handled in a careful manner, incentives can promote intrinsic motivation and creativeness (Eisenberger & Cameron, 1996). None the less the predominance of evidence shows that providing rewards for tasks in a spontaneous or in a routine setting will destroy both intrinsic motivation and imagination. (Hennessey & Amabile, n.d.) In general, a majority of scientific research strongly supports intrinsic motivation to outweigh extrinsic motivation so more research is needed towards motivation and incentives.

1.3.5 Motivational synergy and entrepreneurial creativity

The scholar Amabile offers a very clear explanation of the idea of intrinsic motivation influenced by an individual perception of a task which is interesting, involving and challenging and extrinsic motivation with the reasons for the person to participate in a task. If the reasons have to do with the task as a means of positive, skill-exercise experience or self-expression, then the individual is intrinsically motivated. If the motives have to do with the task as a way to some external goal, or an answer to some external influence, then a person is driven in an extrinsic context. Amabile suggests that the dominant psychological view is that extrinsic motivation works in opposition to intrinsic motivation. Amabile indicates that the general understanding is if strong extrinsic motivators are introduced for engagement in a task, intrinsic motivation for the task will decline. Against this backdrop, Amabile continues to explain that there are numerous factors that can be seen as extrinsic motivations that encourage creativity, such as rewards and appreciation of creative ideas or clearly defined overall project objectives or even regular feedback on the progress on tasks. (Amabile, 1997) Also, research by Deci and Ryan has introduced the idea that under very specific situations rewards can have either no impact or even a positive impact on intrinsic motivation and creativity in their cognitive evaluation theory. (Ryan & Deci, 2000) A motivational synergy described by Amabile suggests that extrinsic motivators can be combined positively with intrinsic motivation. The extrinsic motivation which would support competence or deeper involvement with a task would support intrinsic motivation and creativity. Essentially intrinsic motivation needs to be high so that information and enabling extrinsic motivation will be conductive. Due to the various definitions of creativity and its influence from intrinsic and extrinsic motivation the scholar Amabile introduces the term entrepreneurial creativity. Entrepreneurial creativity as Amabile suggests is the creation of new and useful ideas for businesses in organizations or start-ups. Entrepreneurial creativity needs a combination of intrinsic and extrinsic motivation which Amabile refers to as a motivational synergy. Enabling extrinsic motivation that is linked to entrepreneurial creativity is support for skill development, enabling achievement of a task and confirming competence. Amabile, therefore, argues that entrepreneurship in its form is a particular form of innovation. (Amabile, 1997)

1.4 Summary of research findings supportive to enterprise crowdfunding

In summary we can understand from scholars that entrepreneurial creativity is closely linked to systemic motivation, where the ideal form for entrepreneurs is a combination of extrinsic incentives and intrinsic motivation. Close attention needs to be paid to the frequency and amount of extrinsic incentives in order to avoid any overjustification effect and lose intrinsic motivation of participants. In summary the concept of money can lead to negative social behavior, but for people contributing for free may find this to be unfair. We also understand that in a crowdfunding system which are donation or reward-based, a decision making by participants can tends to be heuristic and lead to automated behaviors and system 1 type of thinking. The quality of decision-making is therefore influenced heavily by the interest to participate, which leads back to the initial question understanding motivation for participation. Thus, a crowdfunding system that supports equity end lending could introduce the concept of money as well as make contributions transparent and valued. Equity and lending crowdfunding will require participants to use system 2 thinking if they decide to invest their personal money. Process model for equity and lending enterprise crowdfunding

Nepotism might still prevail but in a form of individuals rationales to justify an action or donation. Crowdfunding can also provide for a simple solution for renumeration in a crowd work environment. The following will provide with a simple proposal for an enterprise crowdfunding process model for equity and lending incentives.

2 Process model for equity and lending enterprise crowdfunding

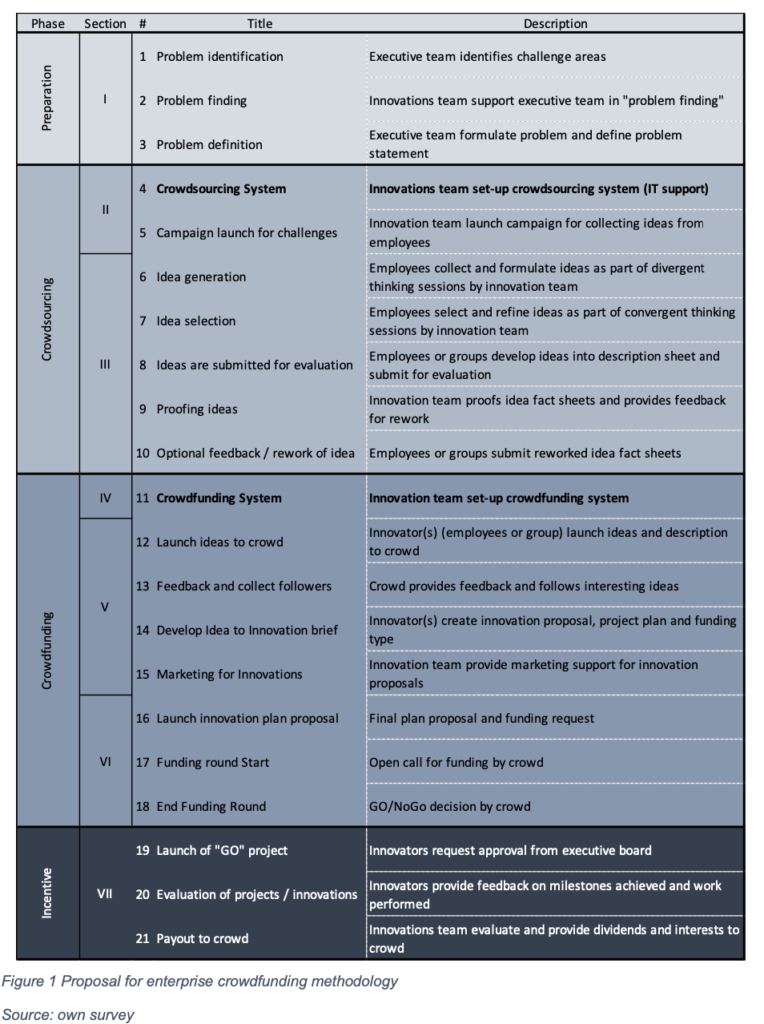

The suggested process model for an enterprise crowdfunding system is divided into 4 Phases and broken down into seven sections. These four phases consist of preparation, crowdsourcing, crowdfunding and incentives. For crowdsourcing and crowdfunding there are numerous methodologies and process models available, however non are described in a very detailed manner. The following proposal is therefore developed by own account and outlines deliverables with description for each item.

2.1 Four phases of an enterprise crowdfunding model

The first, also regarded as the preparation phase focuses on the problem identification by the executive team and to develop a problem statement with support from the innovations team. The second or crowdsourcing phase is broken down into two sections. Section II summarizes the set-up of the crowdfunding system and platform as well as the launch of idea sourcing campaigns towards the employees. The section III, as part of the crowdsourcing phase contains sessions held by the innovations team to generate and refine ideas, and an evaluation from innovation team on submitted ideas by employees. The third phase is the crowdfunding phase in which ideas are selected by the crowd of employees. Section IV provides room for the crowdfunding platform set-up and launching of ideas to employees. Section V entails the collection of followers and their feedback, developing ideas into a more formal project plan and proposal with initial marketing tactics to support the formulation of ideas into innovations. Section VI and the final section of the crowdfunding phase focuses on the launch of the plan proposal and innovation to the crowd, with the official request for funding and the type of funding. With successful funding achieved, projects enter the final phase of incentive, where projects are approved by the executive board and evaluated on a regular basis based on milestone achievement and work performed. Payout to the crowd is based on the achievement of deliverables and milestones which are evaluated by the innovation team or by a nominated and independent team of experts.

2.2 The stakeholders of an enterprise crowdfunding model

While the previous process model explained deliverables, the following description tries to elaborate on the major stakeholders in an enterprise crowdfunding model. The identified stakeholders are the executive team, the innovation management team and employees that are providing ideas to the crowd as well as employees that provide the funding.

2.2.1 The employees as Investors in an enterprise crowdfunding system

The employee as funder can influence an innovation by providing funds in return for equity and dividends or interests from lending. Based on two psychological mechanisms outlined by Amabile a positive combination of intrinsic and extrinsic motivation is possible. Especially with high levels of intrinsic motivation, synergistic extrinsic motivators provide positive effects and informational and enabling extrinsic motivation also are favorable towards creativity and intrinsic motivation. (Hennessey & Amabile, n.d.) Therefore, equity and lending should be introduced to employees at an early stage of installing an enterprise crowdfunding. Where the intrinsic motivation for employees is still high to participate. The rewards from equity and lending should be infrequent and the amount of payout should be not foreseeable to reduce the probability of an undermining effect.

2.2.2 The employee as innovator in an enterprise crowdfunding system

If funds are raised by employees in return for stringent control measures, then this may weaken entrepreneurial creativity of these employees. Troublesome is, if these employees and entrepreneurs find themselves in circumstances where their sense of self-determination is undermined, they may well begin to cognitively and emotionally disengage from the specific project, and their creativity may decline. Finally, and perhaps most importantly, the extrinsic motivators of tangible reward – such as winning financial funding or achieving generous profit margins – will enable the employee as entrepreneur shift his motivation towards financial rewards. (Amabile, 1997) In an enterprise crowdfunding system creativity can easily be lost if stringent control of a project is handed to executives or funding employees. But entrepreneurial creativity can be increased by presenting the funds primarily as a means of enabling the employee’s entrepreneurial activity. (Amabile, 1997) Thus, funding needs to be clearly linked towards deliverables and milestones and comprehendable to the crowd of employees acting as investors.

2.2.3 The innovation team and crowdfunding platform

First and foremost is the innovations team responsible for the crowdfunding platform and its communication between participants. The innovation team is also responsible for assisting the executives in identifying strategic innovation fields which the crowd should provide ideas for and fund these. Furthermore, is the innovation team responsible for proofing and evaluating ideas as well as for marketing, providing service to the crowd and supporting the employees as entrepreneurs with the formulation of ideas and project proposals. In regards to evaluation of progress of projects, a team of experts could be nominated by the crowd and probably make more informed and accurate evaluations than an innovation team. In cases of high-tech for example a group of experts nominated for a period of time would provide for a more realistic evaluation of a project progress.

2.2.4 The executive team and its responsibility

The executive team most importantly needs to support the framework under which a crowdfunding system can develop and foster employees to generate ideas and provide with the support. This means that the executive team will need to provide an environment for employees to support projects with funds as well as time and knowledge. Essential for the executive team will be to accept that a crowdfunding platform must coexist with an existing hierarchical organization form and be independently managed.

3 Qualitative interviews held with 3 employees

In order to understand what implications and enterprise crowd funding has on employees, following interviews were conducted. Two male and two female candidates were interviewed of which all are part of organizations that have not yet implemented a crowdfunding system. The objective of the qualitative interviews was to understand the motivation or for participation and expectations for rewards.

The profile of interviewed parties:

- A. Kargol. (age: 40, male, profession: Controlling, Verbund AG – energy sector)

- M. Henner (age: 38, female, profession: Marketing, Hypo NOE AG – banking sector)

- T. Veit. (age: 37, female, profession: Clinical Manager, Baxter – pharmaceutical sector)

3.1 Questions for the qualitative interviews

The following five questions were the basis for the qualitative interviews. Many more questions for deeper understanding and clarification were asked.

- Have you or someone you know submitted new business ideas to your employer?

- Under what circumstances would you support and pursue these ideas?

- How motivated would you be to do this in your free time? in exchange for shares?

- How motivated would you be to buy shares / invest your own money into the project?

- What would you seem appropriate as compensation if you would pursue this project together with your current profession?

Based on these questions a number of interesting topics and dormant questions were uncovered leading to blind-spots and further research leading to some simple and introductory suggestions and answers. Many of these blind-spots and topics of interest will need to be analyzed in more detail to provide a scientific answer.

3.2 Summary of interviews held on enterprise crowdfunding

Interviewee Marlis Henner confirmed that she was aware of a project that was nominated by an employee, but due to lack of management commitment the project was badly implemented. M. Henner mentioned that the project team was not linked to the success of the implementation. M. Henner would consider an extrinsic incentive to be motivating for her to participate on such a project but would closely follow the system before investing private money. M Henner would prefer to invest if her salary would contain an element of capital that she would be able to invest. Private money linked to company project would not motivate M. Henner to invest her money because she would feel her money could be locked into a project and limit her options when leaving company.

Interviewee Alexander Kargol confirms that he himself had an idea to improve efficiency in the company he works for. He states that executives had lack of interest to pursue his idea. If the idea was accepted and supported, then a team would have implemented this idea. A. Kargol would differentiate if the project would be part of his work or part of free time. He mentioned that at a recent project where he contributed freely had received a financial reward. A. Kargol stated that for interesting projects he would be willing to support with his free time and also stated that he would be interested in investing his own money on these projects. A. Kargol finds extrinsic rewards to be beneficial for a company and in terms of such an enterprise crowdfunding system he mentions that dividends should be related to the project similar to how these are handled with shadow shares. Just for financial benefits A. Kargol would not necessary spend his free time, but interesting would be a system that could allow for both financial gains as well as worktime compensation or time off work. A. Kargol finds an ECF model could positively influence an employee retention and commitment towards projects initiated by the company. A. Kargol sees that 30% of work time could be allocated to projects or even a day per week. He clearly indicates that the framework for worktime needs to be set first. A. Kargol finds that management and thus hierarchical organizations are hindering in idea generation, selection and implementation.

Interviewee Tina Veit is working in a division where work is done based on very strict protocols. She mentioned that in her division idea generation and innovation is not sought after. T. Veit however would be interested in supporting innovations financially if they were proposed to her as part of a crowdfunding campaign. Lack of transparency or visibility limit her knowledge about innovations in other divisions of her organization.

3.3 Considerations derived from interviews

An equity or lending type of enterprise crowdfunding is not necessarily for every idea for project. It also needs to be considered that not all projects at an early stage necessarily need financial support. Funding rounds can be introduced at the later stage or spread over multiple stages. The Innovation management team together with the crowd should be able to decide whether a project should be nominated for financial support. Following sections will try to provide answers to questions that were raised during the interviews.

3.3.1 How much could an employee invest in enterprise crowdfunding?

Important at this point is to limit the amount of personal investment an employee can provide. A portfolio investment of high-risk investments can be in the area of 10% to 20% but not limited to this. Because the risks of crowdfunding investments and lack of common rules across the EU, the European regulations have granted a proposal on 19th December 2019 under which the EU Commission is developing policies for equity and lending crowdfunding to be regulated and become legal. Part of this proposal will include a maximum of 5 million Euro funding, the percentage of investment based on individual income and authorizing bodies to supervise crowdfunding. (“Agreed,” 2019)(Commission welcomes agreement to boost crowdfunding in EU, n.d.) Unclear is what regulations will apply for an equity and lending enterprise crowdfunding.

3.3.2 How to deal with further funding requirements?

The term pre-emption right is an industry standard that set a legal framework for businesses that seek further funding. Pre-emption rights ensure that existing investors have the right (but not the obligation) to invest in future fundraising rounds of a business in order maintain their level of shareholding in a company. In such a case venture capitalists and business angels have rights to provide funding when further funding rounds are sought after by the business. Such a right has been implemented to protect investors capital. Typically, such a protection is only available to professional investors with a majority share. If an investor does not act upon the right to provide further funding, then the shares are diluted. Dilution is a term often with a negative connotation, because the shares in terms of equity will reduce if no further funding is provided. Additional fundraising typically indicates that the business is doing well, because funding rounds increase the value of the business. Provided that a company is raising more money at the same or higher valuation, an investor having a smaller share of the business will have a higher value of shares. In other words and investor will be holding a smaller piece of the pie when his shares dilute, but the pie is getting larger. (“Dilution isn’t always a bad thing | Crowdfunding,” 2013) A further important aspect is that pre-emption rights are also seen as one of the most crucial protection for minority investors. Pre-emption rights hinder majority shareholders from issuing new shares to themselves at a low valuation (“How do pre-emption rights affect investor dilution?,” 2017) These pre-emption rights are an important legal framework to be included in enterprise crowdfunding as well as information regarding a potential dilution of shares from investors. Investors might consider diluting their shares and using the capital to diversify into different investment opportunities instead.

3.3.3 How to deal with delayed milestones and objectives not achieved?

Research into Amabile study on extrinsic and intrinsic motivation among entrepreneurs has indicated three significant points that should be considered in enterprise crowdfunding. The weakening of entrepreneurial creativity through strong control measures and loss of autonomy. Extrinsic motivators such as the achievement of additional funding can lead the entrepreneur to continue seeking funding instead of achieving the business objective. (Amabile, 1997) In contrast, financing rounds if combined with clear milestones, activities and deliverables can increase creativity and intrinsic motivation. With the absence of stringent control mechanism, an entrepreneur is held liable to achieve the milestones set. If milestones are not achieved, a “three strikes and you are out” policy could be introduced. Such a policy can be introduced with an assessment if a deadline was missed. In an enterprise crowdfunding system it would be possible for the crowd to nominate a new entrepreneur to pursue the interest of the crowd and its innovation. Internal factors and external factors such as market and customer requirements need to be reassessed which will lead to new milestones and business plans. Such a reassessment and proposal of a newer and realistic plan will reduce the pressure on entrepreneurs and thus work in favor of increasing motivation and protecting the crowd’s interests.

3.3.4 How to protect financial interests of investors and company?

A company that is implementing an enterprise crowdfunding model not only will want to protect its interests with innovations to be launched but employees will want to protect their investments. There are two topics to be considered, which are majority voting rights and investment guarantee for employees. Firstly, the majority share as well as voting rights of the company can be protected by providing a double up equity program towards an employee’s investment. In a double equity program, each invested amount is matched by the company with an equivalent amount. By this the company can be sure to remain in a dominant position and majority shareholder of any project. Secondly, providing double up equity towards employee’s personal investment could have positive effect on encouragement to undergo an investment. Further research into this will have to provide justification for this argument. But generally, we can understand that any form of guarantee and incentive might have an impact on system 1 and system 2 type of thinking and decision-making which was addressed earlier in this paper.

3.3.5 How to value work and funding using a crypto currency?

In an enterprise crowdfunding system employee would invest their private funds towards innovations. These funds could be provided in form of a currency as part of their salary, as part of work provided or in form of a crypto currency. The advantage of a crypto currency would be that it would open up a trading platform for employees to invest into multiple innovations and trade among each other. A crypto currency could not only provide as a valuation of financial funds but also provide as a valuation for time and work provided towards an innovation. Thus, employees providing support towards the launch of innovation will receive cryptocurrencies in return. The overall value of the innovation could be then also measured by the amount of crypto currencies raised in form of financial support as well as work performed. As highlighted by Thomas in his article about crypto currencies and the evolved process around ICO 2.0 there are examples of regulatory and compliant turnkey solution that provide founders with an option to offer a non-convertible preferred share class that pays a dividend and does not cause dilution on an equity level and instead of equity, investors would receive a revenue share. (Thomas, 2018) If the crypto currency is linked to the company’s valuation or stock market price, then the crypto currency would be protected against volatility. It would also be possible for each innovation to launch its own crypto currency; however, more insights needs to be gained in order to understand if multiple crypto currencies in an enterprise crowdfunding model would create for more transparency towards the progress and the performance of each innovation and be feasible in terms of cost and resources.

3.3.6 How to manage intellectual property rights (IP/R) in an enterprise crowdfunding?

Any IP/R is clearly regulated in an employment contract. Hence any intellectual property is in the ownership of the company. An invention is bound to a person or a group of people, but the rights to use an invention and an intellectual property are with the employer and company. An enterprise crowdfunding system supports employees with a platform to try and launch an idea as well as provides with a protected environment in which to launch the idea. These benefits could play in favor of more conservative entrepreneurs and innovations might form that would have otherwise stayed absent. In addition, a crowdfunding system provides transparency and will allow the innovator to reap the benefits of a successful innovation in form of extrinsic rewards which is not certain in a typical hierarchical organization.

3.3.7 How can employees that are invested in projects leave the company?

The standard among investments is the right to liquidity which as investors with rights to receive certain amount of money back from their investment. In enterprise crowdfunding most of these rights would not be necessary except for the “put option”. The put option allows investors to force the company to buy back the shares at a previously agreed price. (“Put option,” 2019). In the context of enterprise crowdfunding these rights should allow employees to force the company or innovators to buy back the shares from employees based on its previous value. If the current value is less than the market price the employee still has the option to trade his shares for the current market value which is referred to as a right to convert. If the value of the innovation increases, the employees have the right to convert their investment to a regular common stock, other company related assets or even vacation days. Although the right to convert is generally considered fair for crowdfunding investors the right for liquidity is still being debated. Important is understand the difference between equity and lending, where the rights to liquidity as well as the rights to conversion are tools for equity financing and should not be available for loans. (crowdfundattny, n.d.) Funds that are provided for a previously determined timeframe and which provide with a regular interest to employees will be lost or could be transferred to an employee in case of an employee wishing to leave the company.

3.3.8 How can employees take time off or spend time to work on project?

Companies such as Google have introduced workdays where employees can work on their own projects and are not bound to their daily tasks. There are numerous ideas how employees can allocate time to work on their innovations. Clear is that a company that has introduced a crowdfunding system will have enabled a methodology to allow employees to develop their innovation. As outlined in the earlier if extrinsic rewards are available in form of dividends, interests or equity shares then an intrinsic motivation can be increased. It would be interesting to conduct research and understand the correlation of rewards with time spent. Ultimately any work performed towards an innovation project needs to be valued towards the project. Thus, if an employee provides any form of support this should be tracked as a value add and increase the overall value of the innovation. If an hour was added to a project, then this hour cannot be allocated to any other project and also cannot be considered as regular work time. Any work provided towards the project will be compensated via dividends from equity or interest from lending. This will provide a certain guarantee, that hours spent will not be accounted for and remunerated twice.

4 Summary and conclusion

In conclusion the interviews have showed interest of employees in a new type of renumeration as well as being able to receive time off from work in return for work provided. The interest in investing private money towards projects is positive, but it is yet to be seen how much money employees are willing to invest and how much will be allowed for. The participation rate will not necessarily increase because successful crowdsourcing platforms such as the one from TÜV Austria already have a 70% sign-up rate. More interesting is to understand how an equity and lending type of enterprise crowdfunding system could influence the engagement rate of employees. And based on research we can anticipate that private money will have a conductive influence on decision-making as well as on the quality of ideas generated, selected and funded. Furthermore, a stronger form of enterprise crowdfunding can empower employees in a hierarchical organization and thus support organizations in retaining their talents. And equity and lending crowd funding system potentially can help organizations with a new form of renumeration that can co-exist with crowd work and the trend towards a new world of work.

5 Bibliography

Agreed: Harmonised EU rules to boost European crowdfunding platforms. (2019, December 19). European Crowdfunding Network. https://eurocrowd.org/2019/12/19/agreed- harmonised-eu-rules-to-boost-european-crowdfunding-platforms/

Amabile, T. M. (1993). Motivational synergy: Toward new conceptualizations of intrinsic and extrinsic motivation in the workplace. Human Resource Management Review, 3(3), 185–201. https://doi.org/10.1016/1053-4822(93)90012-S

Amabile, T. M. (1997). Entrepreneurial Creativity Through Motivational Synergy. The Journal of Creative Behavior, 31(1), 18–26. https://doi.org/10.1002/j.2162- 6057.1997.tb00778.x

Bretschneider, U., Knaub, K., & Wieck, E. (2014). Motivations for crowdfunding: What drives the crowd to invest in start-ups?

Caruso, E. M., Vohs, K. D., Baxter, B., & Waytz, A. (2013). Mere exposure to money increases endorsement of free-market systems and social inequality. Journal of Experimental Psychology: General, 142(2), 301.

Cholakova, M., & Clarysse, B. (2015). Does the Possibility to Make Equity Investments in Crowdfunding Projects Crowd Out Reward–Based Investments? Entrepreneurship Theory and Practice, 39(1), 145–172. https://doi.org/10.1111/etap.12139

Commission welcomes agreement to boost crowdfunding in EU. (n.d.). [Text]. European Commission – European Commission. Retrieved January 21, 2020, from https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6829

crowdfundattny. (n.d.). Anti-Dilution Rights. Crowdfunding & FinTech Law Blog. Retrieved January 5, 2020, from https://crowdfundingattorney.com/category/anti-dilution-rights/

Dilution isn’t always a bad thing | Crowdfunding. (2013, June 11). Seedrs. https://www.seedrs.com/learn/blog/investors/trends-insights/why-dilution-isnt-always- a-bad-thing-2

Eisenberger, R., & Cameron, J. (1996). Detrimental Effects of Reward. American Psychologist, 14.

Feldmann, N., & Gimpel, H. (2016). Financing projects through enterprise crowdfunding: Understanding the impact of proposal characteristics on funding success.

Feldmann, N., Gimpel, H., Muller, M., & Geyer, W. (2014). Idea assessment via enterprise crowdfunding: An empirical analysis of decision-making styles.

Franke, N., Keinz, P., & Klausberger, K. (2013). “Does This Sound Like a Fair Deal?”: Antecedents and Consequences of Fairness Expectations in the Individual’s Decision to Participate in Firm Innovation. Organization Science, 24(5), 1495–1516. https://doi.org/10.1287/orsc.1120.0794

Gómez, J. M., Sandau, A., Sevimli, K., Schmitt, C., & Halberstadt, J. (n.d.). Proof of concept – Enterprise Crowdfunding. 7.

Gosh, R. A. (2005). Understanding free software developers: Findings from the FLOSS study. Perspectives on Free and Open Source Software, 23–46.

Hennessey, B. A., & Amabile, T. M. (n.d.). Reward, IntrinsicMotivation, and Creativity. 2. Hennessey, B. A., & Zbikowski, S. M. (1993). Immunizing children against the negative

effects of reward: A further examination of intrinsic motivation training techniques. Creativity Research Journal, 6(3), 297–307. https://doi.org/10.1080/10400419309534485

Henry, P. B. (2000). Do stock market liberalizations cause investment booms?ଝ. Journal of

Financial Economics, 34.

How do pre-emption rights affect investor dilution? (2017, April 4). Seedrs.

https://www.seedrs.com/learn/blog/pre-emption-rights-investor-dilution

Jirjahn, U. (2016). Performance Pay and Productivity: A Note on the Moderating Role of a

High-wage Policy: Performance Pay and Productivity. Managerial and Decision Economics, 37(7), 507–511. https://doi.org/10.1002/mde.2786

Kleemann, F., Voß, G. G., & Rieder, K. (2008). Un(der)paid Innovators. Science, Technology & Innovation Studies-. https://doi.org/10.17877/de290r-12790

Kreps, D. M. (1997). Intrinsic Motivation and Extrinsic Incentives. The American Economic Review, 87(2,), 359–364.

Lazear, E. P. (1996). NBER WORKING PAPER SERIES. 36.

Muller, M., Geyer, W., Soule, T., Daniels, S., & Cheng, L.-T. (2013). Crowdfunding inside the

enterprise: Employee-initiatives for innovation and collaboration. Proceedings of the SIGCHI Conference on Human Factors in Computing Systems – CHI ’13, 503. https://doi.org/10.1145/2470654.2470727

Overjustification effect. (2020). In Wikipedia. https://en.wikipedia.org/w/index.php?title=Overjustification_effect&oldid=933558446

Put option. (2019). In Wikipedia. https://en.wikipedia.org/w/index.php?title=Put_option&oldid=933021450

Reiss, S., & Sushinsky, L. W. (1975). Overjustification, competing responses, and the acquisition of intrinsic interest. Journal of Personality and Social Psychology, 31(6), 1116.

Reitzig, M., & Sorenson, O. (2013). Biases in the selection stage of bottom-up strategy formulation. Strategic Management Journal, 34(7), 782–799.

Ryan, R. M., & Deci, E. L. (2000). Self-Determination Theory and the Facilitation of Intrinsic Motivation, Social Development, and Well-Being. American Psychologist, 11.

Schroer, J., & Hertel, G. (2009). Voluntary engagement in an open web-based encyclopedia: Wikipedians and why they do it. Media Psychology, 12(1), 96–120.

Tang, S.-H., & Hall, V. C. (1995). The overjustification effect: A meta-analysis. Applied Cognitive Psychology, 9(5), 365–404.

Thomas, A. (2018, May 31). 3 Ways to Raise Money Without Giving Up Equity. Inc.Com. https://www.inc.com/andrew-thomas/3-ways-to-raise-money-without-giving-up- equity.html

Vohs, K. D., Mead, N. L., & Goode, M. R. (2006). The psychological consequences of money. Science, 314(5802), 1154–1156.

6 List of tables and figures

Figure 1 Proposal for enterprise crowdfunding methodology